Although most people have had some kind of interaction in a real estate transaction or have some working knowledge of the process, the truth is that it’s still something that most people only engage with once every 5-10 years or perhaps even once or twice in a lifetime. Unfortunately, a lot of information regarding real estate transactions is also picked up from HGTV or other TV shows which is generally far from reality (ask Tony about the reality of the show when he was on House Hunters) *For the record, we have nothing but love for HGTV (and Modern Family for that matter), but it’s not always based in reality.*

Over the years there are some misconceptions that we tend to see on a regular basis, so we thought we’d address some of those for you today:

-

- The listing agent will be the only one who is showing your house to potential buyers. – false. HGTV often gets this one wrong. The listing agent could possibly show a buyer if they happen to be working with someone that is a good fit or if a buyer calls the number on the sign out of interest, but generally, buyers will be shown by their buyer’s agent that is representing them in the transaction. If you list your home, it will be shown by agents from all different brokerages as they all have access to the MLS (multiple listings service) – this is a benefit to you because it opens you up to the largest buyer pool for a potential sale.

-

- Open Houses are what sell homes – false.

Another HGTV-led misconception. Even though every home renovation show ever is leading up to “THE OPEN HOUSE,” homes rarely sell to buyers who visited them during an Open House. Agents like open houses because it enables them to find additional customers who are looking to buy or sell homes. While Open Houses definitely don’t hurt your sale chances, it’s unlikely that it will be the determining factor in your sale.

Another HGTV-led misconception. Even though every home renovation show ever is leading up to “THE OPEN HOUSE,” homes rarely sell to buyers who visited them during an Open House. Agents like open houses because it enables them to find additional customers who are looking to buy or sell homes. While Open Houses definitely don’t hurt your sale chances, it’s unlikely that it will be the determining factor in your sale. - Who pays the realtor? The way the commission pay structure is set up is that the seller pays both the listing agent and the agent that represents the buyer, so if a home is listed at 6% commission, then 3% will go to the listing agent, and 3% to the buyer’s agent.

- Open Houses are what sell homes – false.

-

- Once earnest money is collected, the seller gets to keep it if the buyer cancels the contract – false. Yes, the seller does get to keep earnest money in some instances, but there are many ways for a buyer to cancel a contract and still get their earnest money back. For instance, if the buyer cancels during the inspection period, if the home does not appraise for the contract price and a new agreement can’t be reached, or if the buyer loses their financing – these are all situations in which the buyer could cancel the contract and still receive their earnest money back.

-

- Tax appraisal vs. Resale market appraisals – Many people think that a county tax assessment is in line with what the resale value of a house should be. We often see buyers think that a house is overpriced because the listing price is significantly higher than the county tax assessment. The county tax assessment is a rough number used only for taxation purposes and the assessor does not even enter the home. An appraisal that happens during a real estate transaction is generally conducted on behalf of a mortgage lender. This appraiser visits the home, looks at size, finishes, condition, and then compares to comparable homes to make an estimate for fair market value.

-

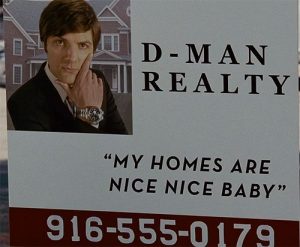

- That guy must sell a lot of houses.

Unfortunately, our industry is fairly unregulated when it comes to marketing yourself and most realtors can advertise themselves however they feel which is often by even promoting other agent’s listings to make themselves appear busier. Also, keep in mind that anybody can be a realtor – in fact, you probably have some family members or friends who may sell it casually on the side. You wouldn’t want someone who practices law as a hobby to represent you in court, so why would you want that for one of the largest purchases of your life?

Unfortunately, our industry is fairly unregulated when it comes to marketing yourself and most realtors can advertise themselves however they feel which is often by even promoting other agent’s listings to make themselves appear busier. Also, keep in mind that anybody can be a realtor – in fact, you probably have some family members or friends who may sell it casually on the side. You wouldn’t want someone who practices law as a hobby to represent you in court, so why would you want that for one of the largest purchases of your life?

- That guy must sell a lot of houses.

-

- What are closing costs? – Although many home shows refer to the commission paid by the seller as the closing costs, we use the term closing costs to refer to the fees that the buyer incurs with their home purchase. These include a variety of expenses and can differ greatly based on the price of the house, the type of the loan, and what else you are including in them like perhaps buying down your rate. They also include things like prepaid homeowners’ insurance and taxes and if you’re putting down less than 20% can include prepaid PMI. Some people also confuse closing costs with their down payment. With most loans, you will need to put at least 3% down (there are many exceptions) toward your principal, but keep in mind that these closing costs that we are referring to are in ADDITION to your down payment. It’s very important to have a good mortgage lender who can explain all of these things up front so you have a clear picture of what you’re getting into.

-

- Home Inspections are Pass/Fail – false –

A home inspection is generally part of a real estate transaction. Once a buyer has an accepted contract, they will hire a licensed inspector to go over the property and give them a report on the condition of the structure and systems of the house. If something is wrong with the house, the seller is not required to fix items. Instead, the buyer will choose any items that they think are unreasonable to be fixed and ask for the seller to either fix them or give money in lieu of the repair. This creates a new negotiation in which the seller can agree, counter, or choose not to make the repairs or give any concessions. Even some home sellers think that their home must be “up to code” before listing, but that is not the point of the resale inspection, it is just to make sure that the condition of the home is acceptable to the purchaser for the agreed-upon price. New construction inspections are different and must pass inspections from the city/county according to new building standards.

A home inspection is generally part of a real estate transaction. Once a buyer has an accepted contract, they will hire a licensed inspector to go over the property and give them a report on the condition of the structure and systems of the house. If something is wrong with the house, the seller is not required to fix items. Instead, the buyer will choose any items that they think are unreasonable to be fixed and ask for the seller to either fix them or give money in lieu of the repair. This creates a new negotiation in which the seller can agree, counter, or choose not to make the repairs or give any concessions. Even some home sellers think that their home must be “up to code” before listing, but that is not the point of the resale inspection, it is just to make sure that the condition of the home is acceptable to the purchaser for the agreed-upon price. New construction inspections are different and must pass inspections from the city/county according to new building standards. - Renovating before you sell is always a good idea – false. While some repairs are good and necessary to receive top dollar for your home, a full renovation done just for the sake of selling is not always the best idea. According to national studies, most renovations only recoup an average of 50% with some of the higher ones at 70% of their cost. Unless you are flipping a home, it’s generally best to do most major renovations for your own enjoyment while keeping the resale buyer in the back of your mind while choosing finishes. We are always happy to have consultations or calls with you if you ever have questions about a remodel or renovation.

- Home Inspections are Pass/Fail – false –

-

- You must disclose if someone has died in a house – false. I don’t know that this is a “common” misconception as we don’t see it come about super regularly, but it’s another one that TV is a little misleading about. The laws of death disclosure differ from state to state and in the states of Kansas and Missouri, you do NOT have to disclose a death unless it was a suicide or murder – and even then, there is a bit of a gray area.

This is just a random collection of thoughts regarding a real estate transaction, but if you’re looking to buy or sell, we’d like to start the process with you by meeting and laying out the procedures of the whole transaction. Even if you’re not currently in the market, we love being your real estate resource and are always available for any questions – even if it’s just to debunk something you saw on TV.