As we progressed through February, the actual and expected impacts of COVID-19 continued to grow, with concerns of economic impact reaching the stock market in the last week of the month. As the stock market declined, so did mortgage rates, offering a bad news-good news situation. While short term declines in the stock market can sting, borrowers who lock in today’s low rates will benefit significantly in the long term.

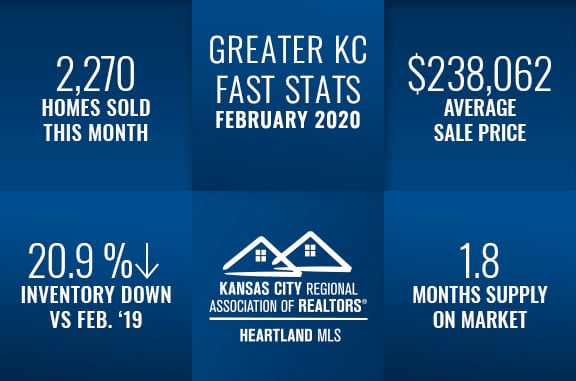

Closed Sales increased 2.9 percent for existing homes and 3.5 percent for new homes. Pending Sales increased 17.3 percent for existing homes and 59.7 percent for new homes. Inventory decreased 22.2 percent for existing homes and 19.9 percent for new homes. The Median Sales Price was up 11.2 percent to $199,250 for existing homes and 0.9 percent to $370,000 for new homes. Days on Market remained flat for existing homes but increased 4.9 percent for new homes. Supply decreased 22.2 percent for existing homes and 15.6 percent for new homes.

The recently released January ShowingTime Showing Index® saw a 20.2 percent year-over-year increase in showing traffic nationwide. All regions of the country were up double digits from the year before, with the Midwest Region up 15.7 percent and the West Region up 34.1 percent. As showing activity is a leading indicator for future home sales, the 2020 housing market is off to a strong start, though it will be important to watch the spread of COVID19 and its potential impacts to the overall economy in the coming months.

For more specific market numbers, click here.

*Information provided courtesy of KCRAR and Heartland MLS