Mortgage interest rates ticked a bit higher in February, but remain below their February 2020 levels. Interest rates may rise a bit further in coming weeks, but according to Freddie Mac chief economist Sam Khater, “while there are multiple temporary factors driving up rates, the underlying economic fundamentals point to rates remaining in the low 3 percent range for the year.” With rates still at historically low levels, home sales are unlikely to be significantly impacted, though higher rates do impact affordability.

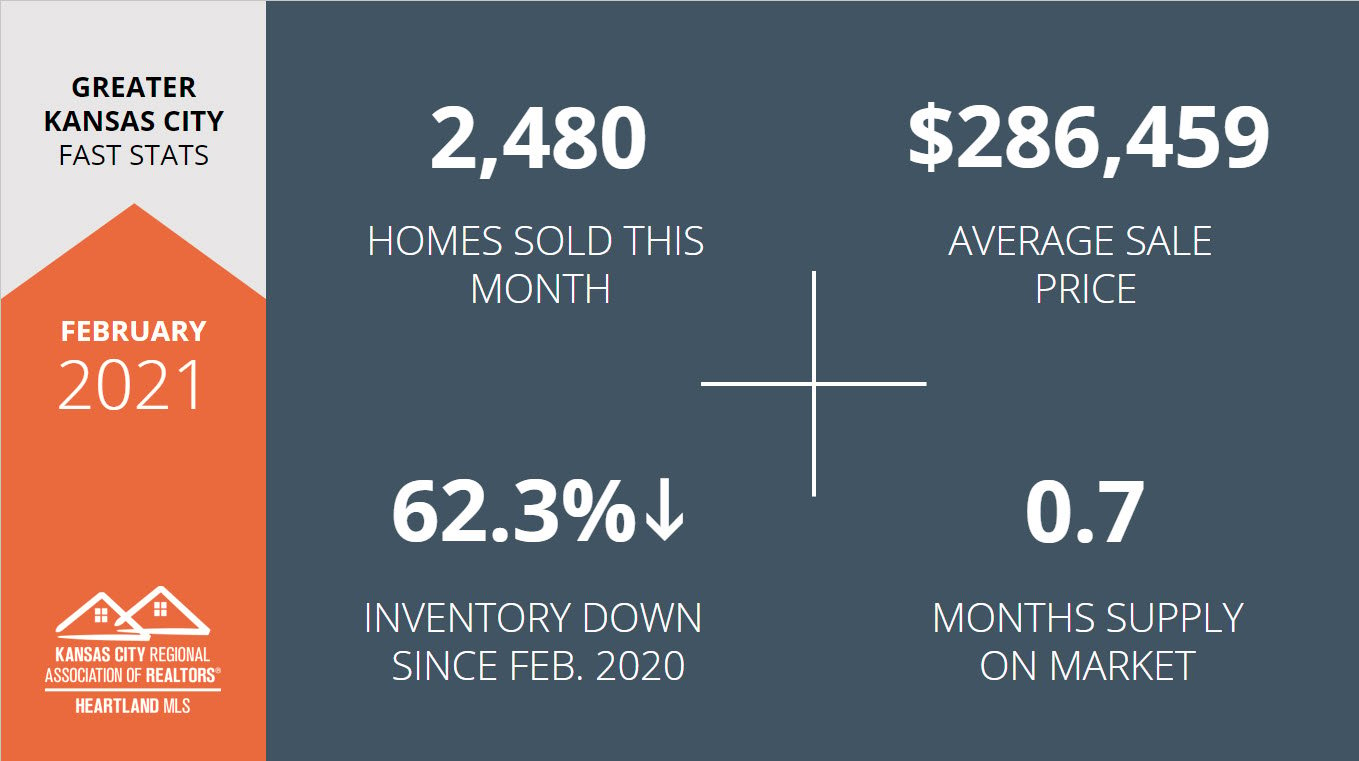

Closed Sales increased 4.6 percent for existing homes and 22.0 percent for new homes. Pending Sales decreased 6.3 percent for existing homes but increased 4.7 percent for new homes. Inventory decreased 64.9 percent for existing homes and 54.5 percent for new homes.

Closed Sales increased 4.6 percent for existing homes and 22.0 percent for new homes. Pending Sales decreased 6.3 percent for existing homes but increased 4.7 percent for new homes. Inventory decreased 64.9 percent for existing homes and 54.5 percent for new homes.

The Median Sales Price was up 13.9 percent to $222,500 for existing homes and 12.3 percent to $412,960 for new homes. Days on Market decreased 45.3 percent for existing homes and 37.7 percent for new homes. Supply decreased 70.6 percent for existing homes and 63.6 percent for new homes. For homeowners currently struggling due to COVID-19, government agencies are continuing efforts to help those in need. The Federal Housing Finance Agency announced they will allow homeowners with loans backed by Fannie Mae and Freddie Mac to receive an additional three months of forbearance, extending total payment relief to up to 18 months.

*Information provided courtesy of KCRAR and Heartland MLS