The U.S. real estate market remains hot ahead of the spring selling season, with existing home sales up 6.7% as of last measure, according to the National Association of REALTORS®. Experts attribute the growth in sales to an uptick in mortgage interest rates, as buyers rushed to lock down their home purchases before rates move higher. Mortgage rates have increased almost a full percentage point since December, with the average 30-year fixed rate mortgage briefly exceeding 4% in February, the highest level since May 2019.

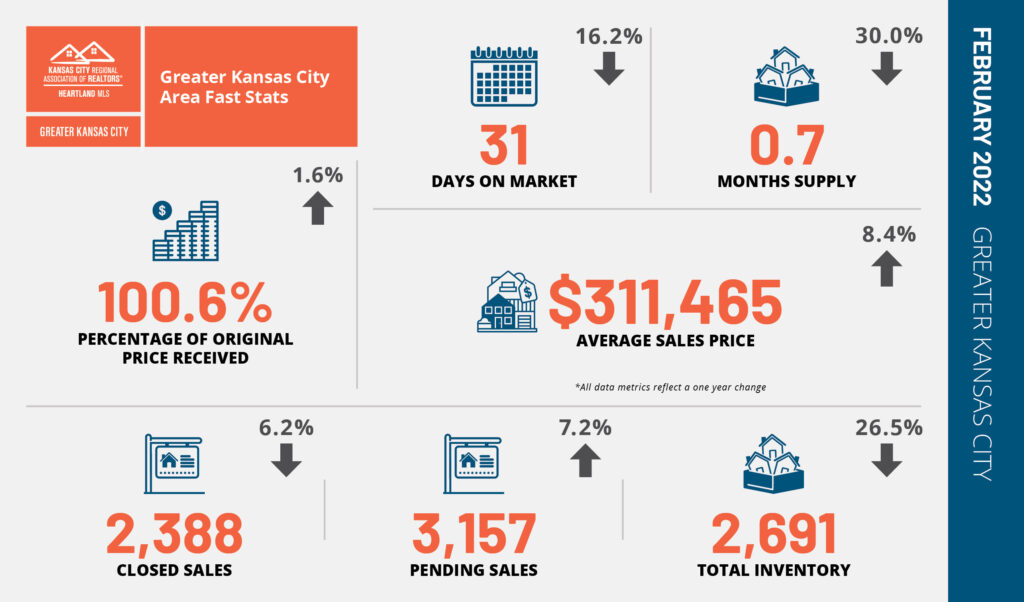

Closed Sales decreased 4.0 percent for existing homes and 21.4 percent for new homes. Pending Sales increased 14.2 percent for existing homes but decreased 23.5 percent for new homes. Inventory decreased 36.1 percent for existing homes but increased 5.7 percent for new homes. The Median Sales Price was up 9.8 percent to $244,900 for existing homes and 19.7 percent to $495,256 for new homes. Days on Market decreased 13.8 percent for existing homes and 17.6 percent for new homes. Supply decreased 44.4 percent for existing homes but increased 28.6 percent for new homes.

Inventory was at an all-time low of 860,000 as February began, down 17% from a year ago and equivalent to 1.6 months supply. According to Lawrence Yun, Chief Economist at the National Association of REALTORS®, much of the current housing supply is concentrated at the upper end of the market, where inventory is increasing, while homes priced at the lower end of the market are quickly disappearing, leaving many first-time buyers behind. The shortage of homes is boosting demand even further, and with bidding wars. Experts attribute the growth in sales to an uptick in mortgage interest rates, as buyers rushed to lock down their home purchases before rates move higher.