In 2015, national residential real estate, by and large, had a good year. Supply and demand were healthy in an environment rife with low interest rates and improved employment. The Federal Reserve finally increased short-term rates in December, and more increases are expected in 2016. Housing markets have shown a willingness to accept this. Save for a few expensive outliers where low inventory and high prices have become the norm, a balanced market is anticipated for much of the country for the foreseeable future. Improved inventory and affordability remain key factors for continued optimism.

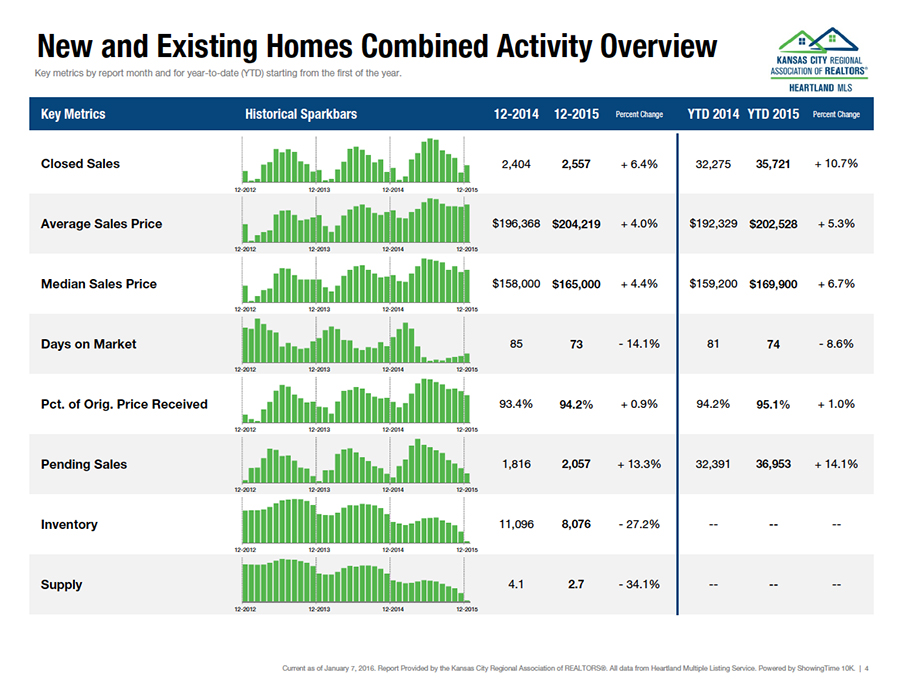

Closed Sales increased 6.5 percent for existing homes and 4.8 percent for new homes. Pending Sales increased 12.6 percent for existing homes and 19.4 percent for new homes. Inventory decreased 29.9 percent for existing homes and 11.6 percent for new homes. The Median Sales Price was up 5.4 percent to $155,000 for existing homes and 3.0 percent to $357,687 for new homes. Days on Market decreased 13.4 percent for existing homes and 14.8 percent for new homes. Supply decreased 36.8 percent for existing homes and 22.5 percent for new homes.

Gross Domestic Product increased at an annual rate near 2.0 percent to close 2015, and that rate is expected to increase next year. Residential real estate is considered a healthy piece of the national economy. Contributing factors from within the industry include better lending standards and foreclosures falling back to more traditional levels. Declining unemployment, higher wages and low fuel prices have also conspired to improve personal budgets.

Click here to view more specific numbers for the KC metro market as of the end of December 2015. If you would like more specific numbers about your neighborhood, feel free to call or email us and we’d be happy to run a more in-depth report. Numbers below are for the entire KC metro area both existing homes and new construction combined.

*Information courtesy of KCRAR and Heartland MLS