In November, the Federal Reserve reduced its benchmark rate for the third time this year. This action was widely anticipated by the market. Mortgage rates have remained steady this month and are still down more than 1 percent from last year at this time. Residential new construction activity continues to rise nationally. The U.S. Commerce Department reports that new housing permits rose 5% in October to a new 12-year high of 1.46 million units.

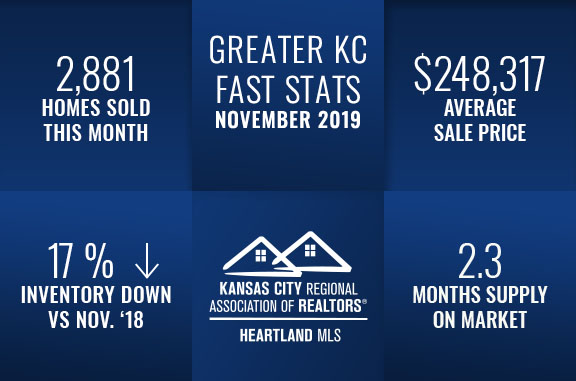

Closed Sales decreased 6.3 percent for existing homes and 22.5 percent for new homes. Pending Sales increased 17.6 percent for existing homes and 18.7 percent for new homes. Inventory decreased 18.7 percent for existing homes and 10.9 percent for new homes. The Median Sales Price was up 5.3 percent to $200,000 for existing homes and 1.4 percent to $372,520 for new homes. Days on Market decreased 4.8 percent for existing homes but increased 11.7 percent for new homes. Supply decreased 17.4 percent for existing homes but remained flat for new homes.

While many economic signs are quite strong, total household debt has been rising for twenty-one consecutive quarters and is now $1.3 trillion higher than the previous peak of $12.68 trillion in 2008. While delinquency rates remain low across most debt types (including mortgages), higher consumer debt loads can limit future household spending capability and increase risk if the economy slows down.

For more specific market numbers, click here.

*Information provided courtesy of KCRAR and Heartland MLS