Home prices across the U.S. are reaching all-time highs, prompting worry over another boom-and-bust scenario like we experienced roughly ten years ago. Yet, as we glance across the state of residential real estate, what is clear compared to the last extended run of price increases is that lending standards are now much stronger than they were before. Incomes must be verified, a reasonable amount of money must be paid toward the home prior to purchase and a more stringent loan approval process is in place to prevent a repeat performance of the Great Recession.

Closed Sales decreased 0.8 percent for existing homes but increased 14.2 percent for new homes. Pending Sales increased 4.9 percent for existing homes and 12.8 percent for new homes. Inventory decreased 30.0 percent for existing homes but increased 7.1 percent for new homes. The Median Sales Price was up 4.5 percent to $185,000 for existing homes and 8.5 percent to $359,925 for new homes. Days on Market decreased 17.6 percent for existing homes and 7.1 percent for new homes. Supply decreased 32.1 percent for existing homes and 5.8 percent for new homes.

In addition to a stronger base upon which to conduct real estate transactions, the overall economy is in better shape than it was a decade ago. More jobs are available, unemployment is relatively low and workers have more faith in their wages and the potential for wage increases. Although we continue to battle an inventory shortage in much of the country, optimism remains high for a successful summer for buying and selling homes.

For more specific market numbers, click here.

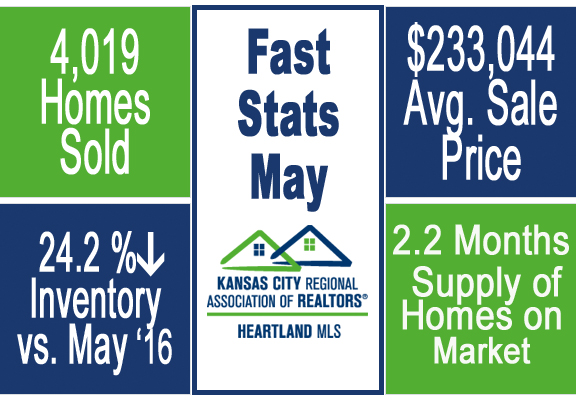

*Information provided courtesy of KCRAR and Heartland MLS