While the stock market recovered significantly in March, the effects of COVID19 to the economy continue to build. In just the last four weeks, more than 20 million people filed initial unemployment claims according to the United States Department of Labor, fueled by stay at home orders and a slowdown of economic activity across the country. Added to the unemployment claims from March, more than 30 million people have become unemployed since COVID-19 has become widespread in the U.S. In the face of these challenging times, real estate activity in April slowed significantly.

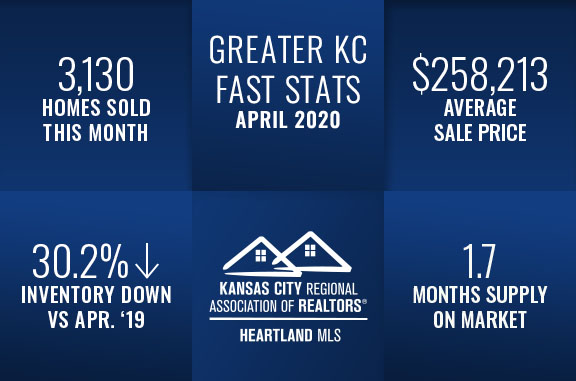

Closed Sales decreased 7.3 percent for existing homes but increased 3.0 percent for new homes. Pending Sales decreased 19.3 percent for existing homes and 24.9 percent for new homes. Inventory decreased 31.8 percent for existing homes and 19.7 percent for new homes. The Median Sales Price was up 7.5 percent to $215,000 for existing homes and 2.8 percent to $369,925 for new homes. Days on Market decreased 20.9 percent for existing homes but increased 10.0 percent for new homes. Supply decreased 30.0 percent for existing homes and 20.6 percent for new homes.

While the effect of COVID-19 continues to vary widely across the country, it is expected that social distancing, higher unemployment, and lower overall economic activity is likely to continue to constrain real estate activity in the near term. At the same time, the industry is adapting to the current environment by conducting business using technologies such as virtual showings and e-signing to help buyers and sellers with their housing needs in the face of these challenges.

For more specific market numbers, click here.

*Information provided courtesy of KCRAR and Heartland MLS