Existing-home sales slid for the second consecutive month, falling 3.4%

nationwide as of last measure, according to the National Association of

REALTORS® (NAR), as higher interest rates continue to impact buyer

affordability. Sales are down 23% compared to the same period a year ago,

while contract signings dropped 20.3% year-over-year. With sales cooling,

buyers in some parts of the country have found relief in the form of declining

sales prices, which are down 1.7% year-over-year nationally, although more

affordable markets continue to see price gains.

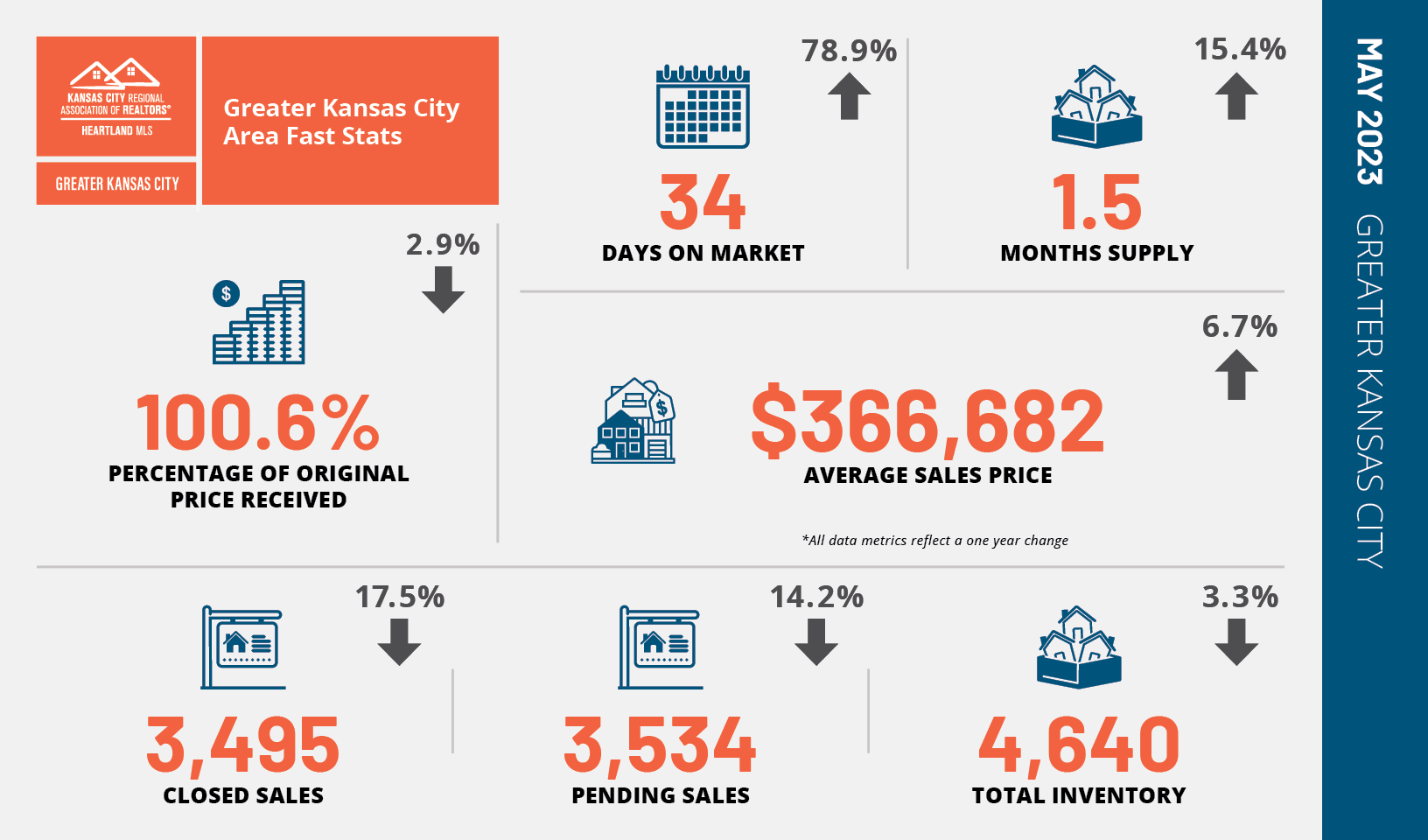

Closed Sales decreased 18.7 percent for existing homes and 4.8 percent for

new homes. Pending Sales decreased 16.9 percent for existing homes but

increased 36.9 percent for new homes. Inventory decreased 16.6 percent for

existing homes but increased 37.1 percent for new homes.

The Median Sales Price was up 2.5 percent to $292,000 for existing homes

and 4.2 percent to $515,590 for new homes. Days on Market increased 57.1

percent for existing homes and 81.8 percent for new homes. Supply increased

10.0 percent for existing homes and 56.8 percent for new homes.

While fluctuating interest rates have pushed some buyers to the sidelines, a

shortage of inventory is also to blame for lower-than-average home sales this

time of year, as current homeowners, many of whom locked in mortgage rates

several percentage points below today’s current rates, are delaying the

decision to sell until market conditions improve. With only 2.9 months’ supply

heading into May, available homes are moving fast, with the typical home

spending just over three weeks on the market, according to NAR.

*Information and stats courtesy of KCRAR and Heartland MLS.