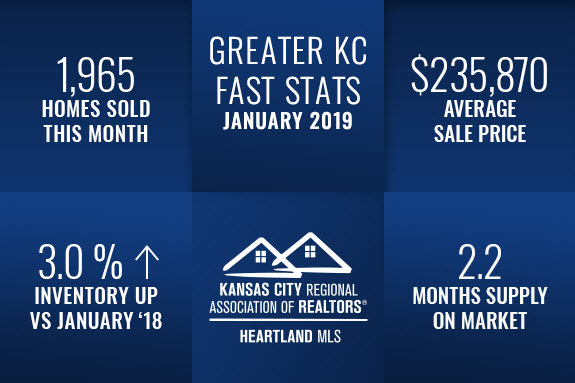

Despite a strong U.S. economy, historically low unemployment and steady wage growth, home sales began to slow across the nation late last year. Blame was given to a combination of high prices and a steady stream of interest rate hikes by the Federal Reserve. This month, the Fed responded to the growing affordability conundrum. In a move described as a patient approach to further rate changes, the Fed did not increase rates during January 2019.

Closed Sales decreased 12.6 percent for existing homes and 16.3 percent for new homes. Pending Sales decreased 3.6 percent for existing homes and 25.9 percent for new homes. Inventory increased 0.8 percent for existing homes and 10.1 percent for new homes. The Median Sales Price was up 6.3 percent to $186,000 for existing homes but decreased 2.2 percent to $350,995 for new homes. Days on Market decreased 8.9 percent for existing homes but increased 43.3 percent for new homes. Supply remained flat for existing homes but increased 8.5 percent for new homes.

While the home affordability topic will continue to set the tone for the 2019 housing market, early signs point to an improving inventory situation, including in several markets that are beginning to show regular year-over-year percentage increases. As motivated sellers attempt to get a jump on annual goals, many new listings enter the market immediately after the turn of a calendar year. If home price appreciation falls more in line with wage growth, and rates can hold firm, consumer confidence and affordability are likely to improve.

For more specific market numbers, click here.

*Information provided courtesy of KCRAR and Heartland MLS