The US housing market began the year in a state of rebalance, with many

buyers and sellers remaining cautious while they wait to see where the market

is headed. Nationally, pending sales rose 2.5% month-to-month, marking the

first increase since May, while sales of existing homes fell 1.5% as of last

measure, according to the National Association of Realtors® (NAR). Demand

for housing persists, but higher mortgage interest rates have cut into housing

affordability, with total home sales down 17.8% last year compared to 2021.

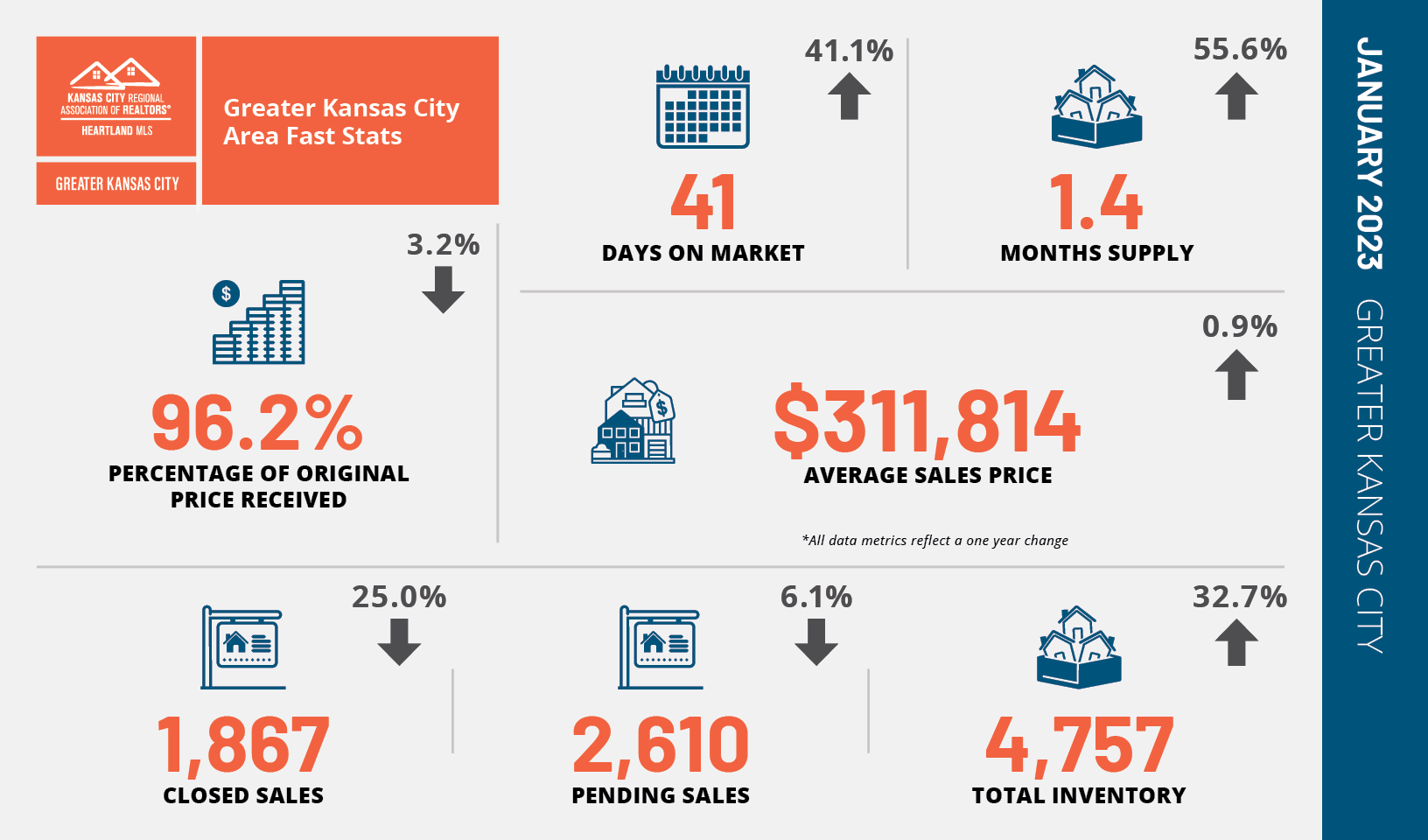

Closed Sales decreased 24.0 percent for existing homes and 33.7 percent for

new homes. Pending Sales decreased 3.0 percent for existing homes and

27.5 percent for new homes. Inventory increased 14.7 percent for existing

homes and 74.7 percent for new homes.

The Median Sales Price was up 4.3 percent to $245,000 for existing homes

and 19.0 percent to $555,402 for new homes. Days on Market increased 42.3

percent for existing homes and 36.1 percent for new homes. Supply increased

42.9 percent for existing homes and 103.1 percent for new homes.

As sales slow, time on market is increasing, with the average home spending

26 days on market as of last measure, according to NAR. Seller concessions

have made a comeback, giving buyers more time and negotiating power when

shopping for a home. Although home prices remain high, mortgage rates

declined steadily throughout January, falling to their lowest level since

September, sparking a recent surge in mortgage demand. Lower rates should

aid in affordability and may soon lead to an uptick in market activity ahead of

the spring selling season.

*Information and stats courtesy of KCRAR and Heartland MLS.