In addition to the quandary of ongoing housing price increases and affordability concerns in many U.S. markets, the first quarter of 2019 saw a fair share of adverse weather as well. Sales totals were mixed across the nation and sometimes dependent on what was a persistent wintry mix, especially in the Great Plains, Midwest and Northeast. Meanwhile, new listings and total homes for sale have been trending lower in year-over-year comparisons in many areas, and last year’s marks were already quite low.

Closed Sales decreased 10.1 percent for existing homes and 30.2 percent for new homes. Pending Sales decreased 2.4 percent for existing homes and 10.9 percent for new homes. Inventory decreased 6.9 percent for existing homes but increased 1.3 percent for new homes. The Median Sales Price was up 5.5 percent to $195,000 for existing homes and 9.6 percent to $365,780 for new homes. Days on Market increased 2.0 percent for existing homes and 15.6 percent for new homes. Supply decreased 5.9 percent for existing homes but increased 5.3 percent for new homes.

The Federal Reserve recently announced that no further interest rate hikes are planned for 2019. Given the fact that the federal funds rate has increased nine times over the past three years, this was welcome news for U.S. consumers, which carry an approximate average of $6,000 in revolving credit card debt per household. Fed actions also tend to affect mortgage rates, so the pause in rate hikes was also welcome news to the residential real estate industry.

For more specific market numbers, click here.

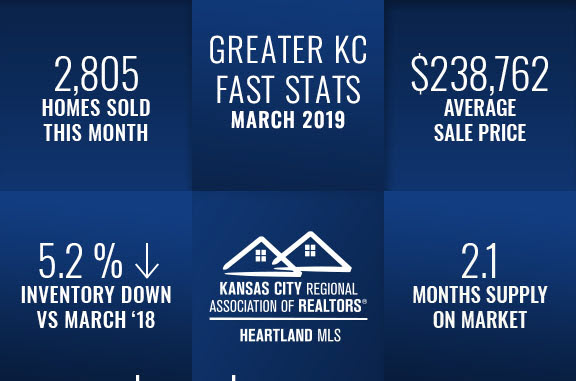

*Information provided courtesy of KCRAR and Heartland MLS