The U.S. real estate market continues to slow as we move into fall, as rising

consumer prices and higher mortgage interest rates squeeze homebuyer

budgets and cool activity. With inflation showing little sign of abating, the

Federal Reserve implemented another 75-basis-point hike in September,

marking the third such rate increase this year. The cost of borrowing has

reached multi-year highs on everything from credit cards to auto loans in 2022

as mortgage interest rates topped 6% for the first time since 2008, causing

existing home sales to decline for the seventh consecutive month.

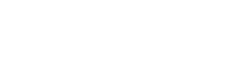

Closed Sales decreased 18.5 percent for existing homes and 18.4 percent for

new homes. Pending Sales decreased 20.0 percent for existing homes and

25.9 percent for new homes. Inventory decreased 3.8 percent for existing

homes but increased 58.1 percent for new homes.

The Median Sales Price was up 10.0 percent to $275,000 for existing homes

and 22.2 percent to $573,006 for new homes. Days on Market increased 23.5

percent for existing homes but decreased 3.4 percent for new homes. Supply

remained flat for existing homes but increased 86.2 percent for new homes.

Affordability challenges have priced many buyers out of the market this year,

and buyers who do succeed in purchasing a home are finding that the costs

of homeownership have increased significantly, with monthly mortgage

payments more than 55% higher than a year ago, according to the National

Association of REALTORS®. Inventory remains lower than normal, and as the

market continue to shift, experts project homes will begin to spend more days

on market and price growth will slow in the months ahead.

*Information and stats courtesy of KCRAR and Heartland MLS.