As the summer draws to a close, multiple opposing factors and trends are competing to define the direction of the real estate market. After the Federal Reserve lowered its benchmark interest rate on July 31, 30-year mortgage rates continued to decline, approaching all-time lows last seen in 2016. Yet most experts agree these reductions are unlikely to bring sufficient relief, at least in the short term, for first-time home buyers. The lack of affordable inventory and the persistence of historically high housing prices continue to affect the housing market, leading to lower-than-expected existing home sales at the national level.

Closed Sales decreased 3.5 percent for existing homes but increased 2.6 percent for new homes. Pending Sales increased 5.5 percent for existing homes and 13.0 percent for new homes. Inventory decreased 13.0 percent for existing homes and 7.9 percent for new homes. The Median Sales Price was up 12.1 percent to $213,000 for existing homes but decreased 0.8 percent to $365,000 for new homes. Days on Market decreased 8.1 percent for existing homes but increased 20.2 percent for new homes. Supply decreased 8.3 percent for existing homes but increased 1.8 percent for new homes.

As many homeowners refinanced their homes to take advantage of declining interest rates, consumer confidence in housing was reported to be at historically high levels. Even so, real estate professionals will need to monitor the market for signs of continued imbalances. Although the inventory of affordable homes at this point remains largely stable, it is stable at historically low levels, which may continue to push prices higher and affect potential buyers across the U.S.

For more specific market numbers, click here.

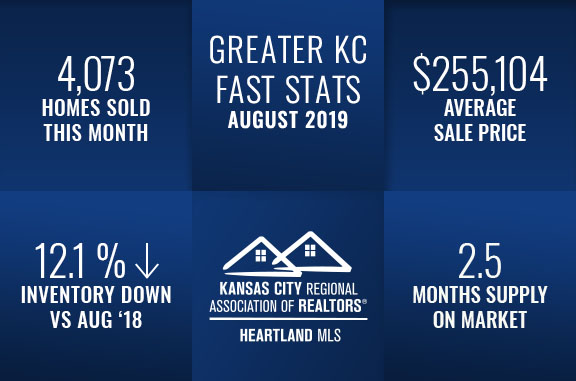

*Information provided courtesy of KCRAR and Heartland MLS