The White House announced additional measures to help struggling homeowners avoid foreclosure as they exit forbearance, including loan modifications and payment reductions. Borrowers with federally backed mortgages can lock in lower interest rates and extend the length of their mortgages. For those who can’t resume monthly payments, HUD will offer lenders the ability to provide all eligible borrowers with a 25% principal and interest reduction.

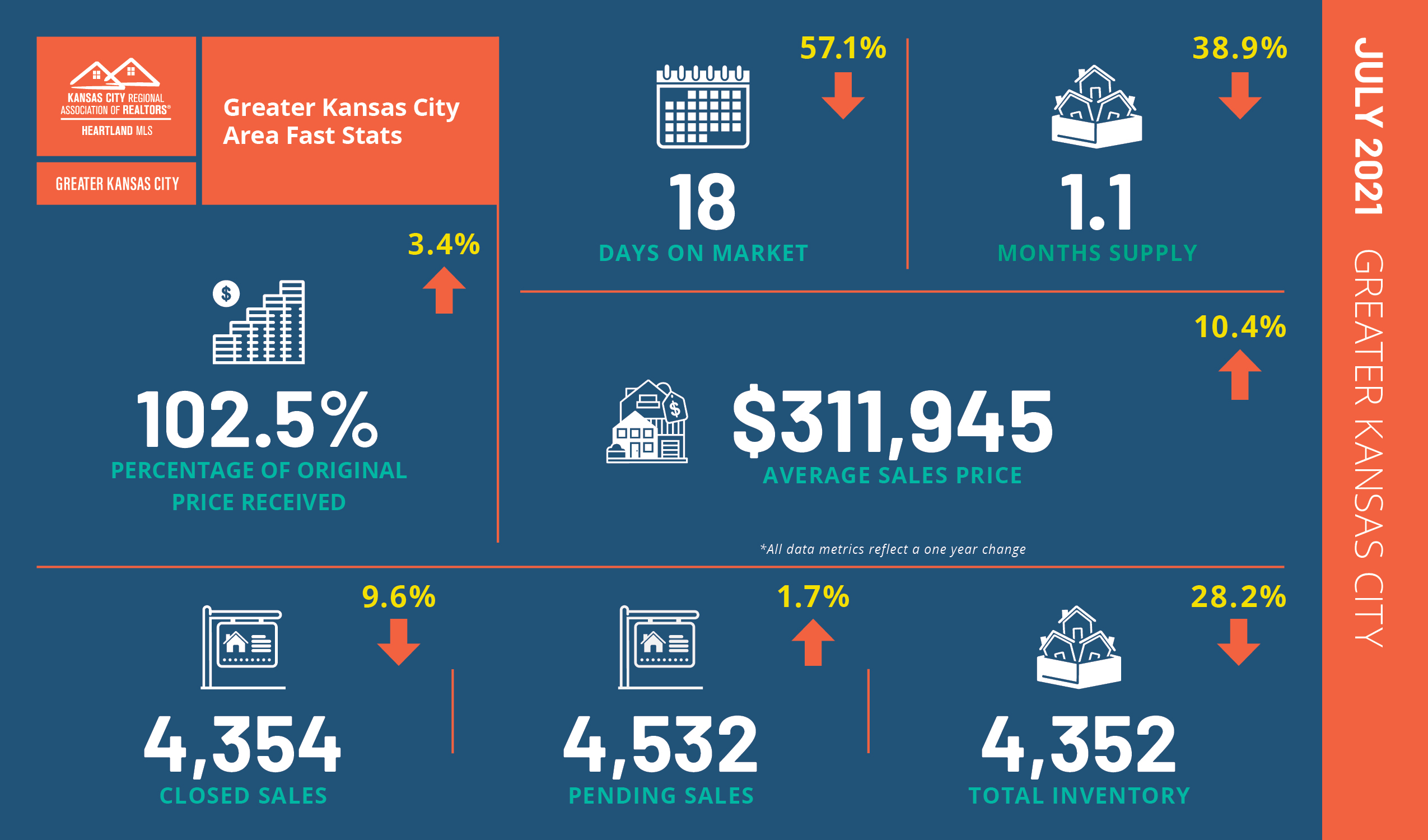

Closed Sales decreased 7.2 percent for existing homes and 30.8 percent for new homes. Pending Sales increased 11.2 percent for existing homes but decreased 63.5 percent for new homes. Inventory decreased 25.1 percent for existing homes and 40.2 percent for new homes.

The Median Sales Price was up 13.9 percent to $265,000 for existing homes and 16.1 percent to $446,900 for new homes. Days on Market decreased 53.3 percent for existing homes and 57.4 percent for new homes. Supply decreased 31.3 percent for existing homes and 44.4 percent for new homes.

The National Association of REALTORS® reported inventory of homes for sale nationwide rose slightly in June as more sellers list their homes, hoping to take advantage of record-high sales prices across the country. Even with renewed home seller interest, inventory overall remains 18.8 percent lower than a year ago, according to NAR.

*Information and stats courtesy of KCRAR and the National Association of REALTORS®