While the effects of COVID-19 in the broader economy continue, real estate activity is beginning to recover across much of the country. According to Freddie Mac, mortgage rates have been below 3.3 percent for more than four weeks and are hovering near all-time lows, spurring strong interest by buyers and lifting showing activity up 4% nationally versus a year ago in the final week of May.

Closed Sales decreased 24.1 percent for existing homes and 12.9 percent for new homes. Pending Sales increased 5.6 percent for existing homes and 24.2 percent for new homes. Inventory decreased 39.9 percent for existing homes and 24.8 percent for new homes. The Median Sales Price was dead even with last year for both property types. Days on Market decreased 2.9 percent for existing homes and 20.3 percent for new homes. Supply decreased 40.9 percent for existing homes and 24.6 percent for new homes.

Buyers have been quicker to return to the housing market in force than sellers, who have been showing a bit more reluctance to list their homes than is typical for this time of year. But trends are improving and as states and localities continue to moderate their COVID-19 policies, real estate activity is expected to continue to improve in the coming weeks.

For more specific market numbers, click here.

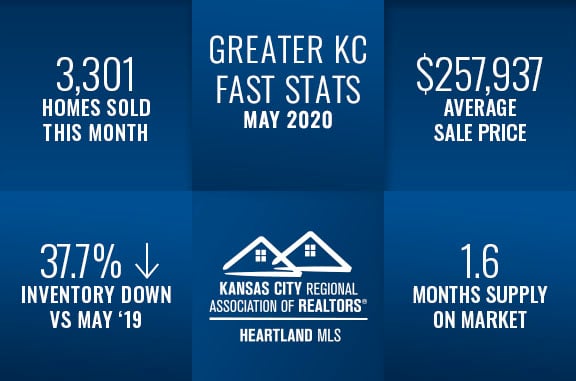

*Information provided courtesy of KCRAR and Heartland MLS